By Vishal Chakravarty

The pharmaceutical market access landscape in Europe has bifurcated. What was once a unified regulatory ecosystem governed by the European Medicines Agency is now two parallel systems: the EU’s EMA-led framework and the UK’s independent MHRA-administered regime. This split, finalized on January 1, 2021, with refinements through the Windsor Framework on January 1, 2025, fundamentally altered how pharmaceutical companies access these markets.

Rather than simple bureaucratic friction, this divergence has reshaped the underlying market structure, creating distinct opportunities for operators who understand both systems.

The Post-Brexit Reality: Two Independent Systems

UK Market Access via MHRA

The UK’s Medicines and Healthcare products Regulatory Agency now operates four primary pathways:

1. National Procedure

- Standard timeline: 150 working days from validation

- Application exclusively to MHRA for UK market authorization

- Independent assessment, no reliance on EMA decisions

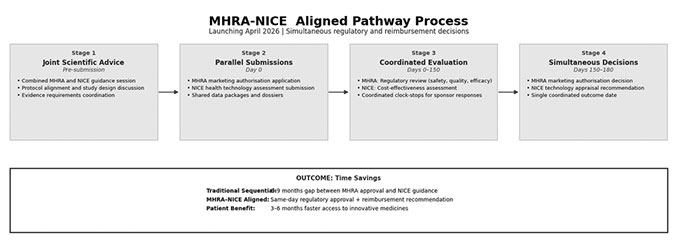

2. MHRA-NICE Aligned Pathway (launching April 2026)

The Medicines and Healthcare products Regulatory Agency and the National Institute for Health and Care Excellence recently announced an integrated pathway enabling simultaneous marketing authorization and health technology assessment decisions.

This innovation eliminates the traditional sequential gap between MHRA approval and NICE cost-effectiveness guidance. Expected time savings: 3-6 months to patient access. The pathway enables companies to receive regulatory approval and NHS reimbursement recommendation on the same day, potentially compressing the UK commercialization timeline significantly.

Joint scientific advice service launches April 2026, providing single-entry coordination between both agencies.

3. International Recognition Procedure

Post-Windsor Framework evolution of earlier reliance procedures. Allows MHRA to recognize approvals from EMA, FDA, TGA (Australia), Health Canada, Swissmedic (Switzerland), and PMDA (Japan). Timeline advantage: Once a reference agency has approved the product, MHRA may grant UK marketing authorisation via the International Recognition Procedure (IRP) under Recognition A (60 calendar days) or Recognition B (110 calendar days), counted from validation, depending on eligibility.

4. Parallel Import Licensing

As of January 1, 2025, under Windsor Framework implementation, parallel import licenses now cover the entire UK including Northern Ireland. All parallel imports require MHRA-issued PLPI licenses.

Application categories include simple PLPI (common ownership or licensing agreement between UK and EU source product holders) and non-simple PLPI (different ownership, requires detailed comparative analysis demonstrating bioequivalence).

New labeling requirement from January 1, 2025: all parallel import products must display ‘UK Only’ marking.

EU Market Access via EMA

The EU retained its three-pathway system, now excluding UK:

1. Centralized Procedure

- Application directly to EMA in Amsterdam

- Standard timeline: 210 active days (typically 12 months including clock stops)

- Decision applies to all 27 EU member states

- Mandatory for biotechnology-derived products, orphan medicines, advanced therapy medicinal products, and products containing new active substances for specific therapeutic areas

2. Decentralized Procedure

- For products not yet authorized in any EU member state

- Simultaneous submission to Reference Member State and Concerned Member States

- Timeline: approximately 210 days

- Result: harmonized national marketing authorizations in multiple member states

3. Mutual Recognition Procedure

- For products already authorized in at least one EU member state

- Timeline: 90 days baseline, potentially extending to 150 days if concerns arise

- Other member states must recognize unless “potential serious risks to public health” identified

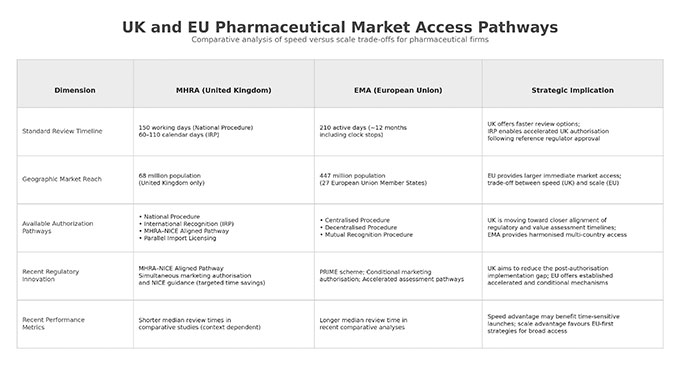

Comparative Analysis: MHRA vs. EMA

MHRA achieved shorter median review times among major regulators in recent years, though this was partially achieved through reliance on EMA decisions via transitional procedures. With Windsor Framework ending those arrangements, MHRA’s independent assessment speed at scale remains to be established.

The Windsor Framework’s Impact on Parallel Import

The Windsor Framework agreement, implemented January 1, 2025, resolved the Northern Ireland pharmaceutical supply regulatory split.

Before Windsor Framework:

- Parallel imports required separate GB-only and NI-specific authorizations

- Centrally Authorized Products in Northern Ireland still followed EU rules

- Regulatory complexity: same product required different licenses depending on UK destination

After Windsor Framework:

- Single UK-wide PLPI license covers all four nations

- MHRA becomes sole licensing authority for all UK parallel imports

- All existing GB-only PLPIs automatically converted to UK-wide authorization on January 1, 2025

This pathway enables parallel import operators to source pharmaceuticals from EU member states and distribute across entire UK with one MHRA license, eliminating previous dual-licensing costs and logistics complexity.

Post-Brexit Regulatory Divergence: Where Systems Differ

Brexit created regulatory separation, though both UK and EU maintain GMP and GDP standards aligned with WHO guidelines. Critical differences emerged:

Pharmacovigilance Reporting: EU reports to EudraVigilance; UK reports to MHRA’s Yellow Card system. Pharmaceutical companies must maintain dual adverse event reporting systems.

Qualified Person Certification: EU requires batch release QP located in EEA member state; UK requires separate UK-based QP. Companies serving both markets need QP capacity in both jurisdictions.

Clinical Trial Approvals: UK Clinical Trials Regulations undergo significant updates April 28, 2026, further distancing UK framework from EU Clinical Trials Regulation. This necessitates separate clinical trial applications, ethics approvals, and trial registrations for UK versus EU studies.

Manufacturing Requirements: From July 23, 2025, UK regulations permit decentralized manufacturing of certain products. This regulatory innovation is not matched in EU framework.

Strategic Implications for Market Entry

The bifurcated system creates three distinct approaches depending on company resources and target markets:

EU-First, Then UK Recognition

Apply via EMA Centralized Procedure (210 active days, EU27 access), then after EU approval, apply via MHRA International Recognition Procedure (IRP) for UK authorisation. IRP follows either Recognition A (60 calendar days) or Recognition B (110 calendar days) from validation, depending on eligibility. Total timeline: approximately 270–320 days to achieve both EU27 and UK access (excluding applicant clock-stops). UK market access is delayed by the EU approval timeline.

UK-First via MHRA-NICE Aligned Pathway

Submit via MHRA-NICE Aligned Pathway (launches April 2026) to achieve simultaneous marketing authorization and NHS reimbursement recommendation, then apply EMA Centralized Procedure for EU access. This positions UK as first-launch market, potentially 3-6 months faster than sequential approaches. Revenue generation begins while EU review proceeds. Requires investment in MHRA submission separate from EMA dossier.

Parallel Dual Submission

Submit to both MHRA (UK National Procedure) and EMA (Centralized Procedure) simultaneously with independent parallel review tracks. Offers fastest possible access to both markets if both approvals succeed. Requires highest regulatory cost and maintaining separate regulatory affairs capacity for MHRA and EMA interactions.

Parallel Import as Market Access Strategy

For generic medicines and off-patent products, parallel import licensing offers an alternative pathway that bypasses traditional marketing authorization requirements.

Pharmaceutical pricing varies significantly across Europe. The same medication can cost substantially more in UK than in certain EU member states. Parallel import addresses this differential within established legal frameworks that UK maintained post-Brexit.

MHRA parallel import requirements include product manufactured to GMP standards, wholesale dealer’s licence covering import, storage, and sale, PLPI licence specific to each product, and if repackaging required, manufacturer’s licence covering product assembly.

For simple PLPIs meeting common origin criteria, approval can occur within 60-90 days. This pathway enables market access for existing EU-approved generic medicines without conducting UK-specific clinical trials or comprehensive regulatory dossiers.

Implications for Market Entry

Post-Brexit pharmaceutical market access increasingly rewards regulatory procedural literacy across both systems. The MHRA-NICE Aligned Pathway launching April 2026 creates a first-launch incentive structure for UK market entry where time-to-revenue and simultaneous regulatory-reimbursement decisions may outweigh immediate access to larger EU27 market size.

For parallel import operations, the Windsor Framework’s January 1, 2025 implementation removed dual GB/NI licensing requirements, creating more streamlined UK parallel import market structure.

Regulatory complexity now functions as a structural advantage: operators who develop deep expertise in both MHRA and EMA frameworks can identify specific product opportunities and navigate approval pathways that larger organizations optimized for centralized EU procedures may find operationally challenging.

Closing Observation

The UK and EU pharmaceutical market access pathways are not harmonized and show no trajectory toward reharmonization. The Windsor Framework resolved Northern Ireland’s regulatory status without addressing fundamental UK-EU procedural divergence.

Organizations must determine whether to optimize for EU market size, UK speed-to-market, or develop dual-system competence to pursue both markets in parallel. Regulatory fragmentation increasingly favors operators with deep procedural expertise over those relying primarily on scale or legacy centralized processes.

Author Profile Information

Name: Vishal Chakravarty

Title: Founder & CEO, NovaPharm Healthcare Ltd

Contact (E-mail): vishal@novapharmhealthcare.com

Bio

Vishal Chakravarty is Founder and CEO of NovaPharm Healthcare Ltd (www.novapharmhealthcare.com), a UK-based pharmaceutical distribution company focused on parallel import operations and cross-border market access in post-Brexit regulatory environments.

He specializes in regulatory compliance strategy for UK-EU pharmaceutical distribution, with expertise in MHRA parallel import licensing frameworks, Good Distribution Practice requirements, and supply chain optimization under bifurcated regulatory systems. His work focuses on practical applications of pharmaceutical regulatory frameworks in cross-border operations.

He writes on UK-EU pharmaceutical regulatory divergence and parallel import operations at vishal.novapharmhealthcare.com.

Series Introduction

“The bifurcation of UK and EU pharmaceutical regulatory systems following Brexit has fundamentally reshaped market access pathways for pharmaceutical companies operating across both markets. This four-part column examines the post-Brexit regulatory landscape: the strategic advantages of UK-specific pathways including the newly integrated MHRA-NICE Aligned Procedure, the compliance implications of regulatory divergence, practical frameworks for parallel import operations under the Windsor Framework, and strategic decision-making for cross-border market entry. Readers will gain actionable insights into navigating dual regulatory systems and identifying market access opportunities in an increasingly fragmented European pharmaceutical environment.”

Series Title

“UK–EU Pharmaceutical Market Access and Compliance in the Post-Brexit Era”

- Article 1 UK and EU Pharmaceutical Market Access Pathways After Brexit

- Article 2 Regulatory and compliance considerations post-Brexit

- Article 3 Parallel import frameworks and risk considerations

- Article 4 Compliance-driven approaches to cross-border market entry